Introduction

Mobilizing finance to undertake huge investments in developing countries remains an uphill task for both public and private sector actors. The investor may be a corporation, a large project or even a sovereign Government who may resort to borrowing from commercial banks to execute their plans. Depending on the magnitude of investment and the sums of money involved, or where the laws of the land do not permit a commercial banks to lend a single borrower beyond a certain threshold , some commercial banks may not have adequate finances to support such big borrowers. To cover the capitalization gap, commercial banks pool monies from their subsidiaries/affiliates to liquidate their coffers and offer such facilities to their potential clients. The subsidiaries/affiliates may be from within or from out the client’s country of investment choice. The financing offered under such an arrangement is known as a syndicated loan or syndicated bank facility, i.e. one where a group of lenders work together to provide funds for a single borrower.

The recent commercial court ruling in Uganda involving a young businessman by the names of Hamis Kiggundu (the borrower) versus Diamond Trust Bank -Uganda (DTB-U) and its affiliate Diamond Trust Bank-Kenya (DTB-K) – the lenders exhibited characteristics of a syndicated loan. In 2017, the borrower in question needed a loan facility amounting to USD 10 million. However, DTB Uganda could only lend him a maximum of USD5.5 million due to regulatory limits by the Bank of Uganda. DTB Uganda was able to rope in DTB Kenya – for a USD4.5 million top-up facility. The loans were secured with mortgages of properties belonging held by the borrower in Uganda under Ham Enterprises and Kiggs Holdings companies.

The Borrower was involved in a myriad of court battles with DTB-U[1] for not honouring his loan payment obligations and threats of attaching his property followed. The borrower claimed that, DTB-U had wrongfully made compulsory deduction from his accounts to repay the loan in question. These court battles culminated into, the businessman seeking legal redress from the commercial court seeking clarity on the relationship between DTB-U and DTB-K and legality to administer syndicated loans in Uganda. The commercial court ruled in favour of the borrower. According to the laws of Uganda, loans extended using monies that are not collected from depositors in Uganda and funds from international, regional or development finance institutions are not under the regulatory mandate of the central bank. Secondly, that DTB-K was illegally conducting financial institutions business in contravention of the Financial Institutions Act (2004) as amended.

Risks of IFFs and Red Flags

Since the case in A, above is up for appeal by the lenders, and without undermining the prejudice principle, from the economic justice angle, my case for potential risk of Illicit Financial flows is premised on the following Red Flags;

- The sums of money involved: Whereas the spirit of acquiring a huge loan for investment is in good faith. The amount borrowed by Ham was above the threshold mandated by the central bank to commercial banks for a single borrower. This should send an alarm to both the financial intelligence authority and the Uganda Revenue Authority to establish the source of income for the borrower in question. Secondly, out of the 26 licensed and supervised commercial banks in Uganda, only four (4) are local banks, the rest are foreign owned. It follows, that over regulation may stifle inflow of foreign loans, while under regulation can provide a breeding ground for syndicated loan arrangements using subsidiaries and risks of money laundering.

- The nature of investment financed by the syndicated loan: Ham’s investments are largely into real estate, even the mortgages against which the syndicated loan in question was secured consequently subject to attachment by the lenders are commercial buildings and housing estates. The Real estate characterised is by heavy investment costs, middlemen, large investments in residentials, albeit few in commercial buildings and a few banks specialise in mortgage financing . Therefore, majority of operations in the sector are funded using borrowed funds. This coupled with a feeble regulatory framework on housing makes investment in the sector susceptible to proceeds from illegal activities and institutionalised corruption.

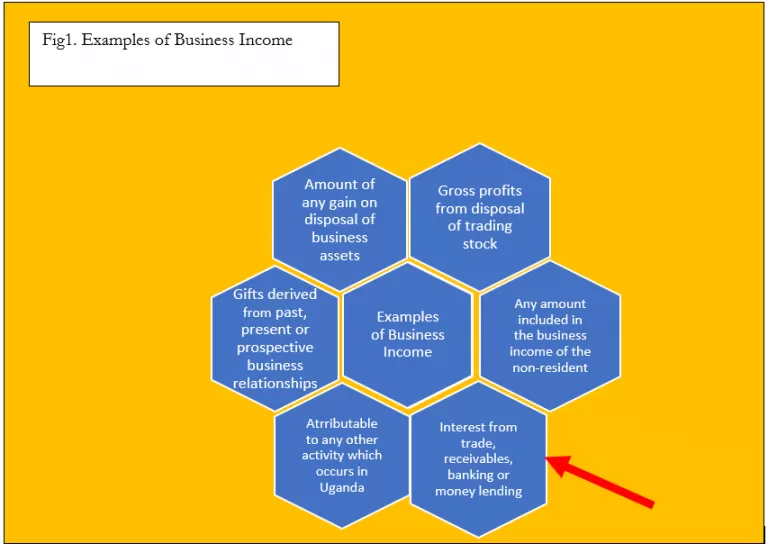

- Risk of Utilising Domestic Tax Laws for aggressive tax planning: Income Tax: Income Tax Act CAP 340 (ITA) of Uganda as amended provides for taxation of business of income for both residents and non-residents. For residents, tax is charged from worldwide income, i.e. income earned from within and outside Uganda while for Non-residents, tax is only charged on income sourced within Uganda. The categories of business income subject to tax under section 18 of the same act are shown in fig1 below.

From the figure above, under normal circumstances, a taxable person who pays interest must withhold at a rate of 15% except under in existence of a double taxation agreement which provides a preferential rate of 10%.

However, section 83 (5) of the ITA exempts interest payments under Tax on International Payments, from withholding tax if the following conditions are met.

- The debentures were issued by the company outside Uganda for the purpose of raising a loan outside Uganda;

- the debentures were widely issued for the purpose of raising funds for use by the company in a business carried on in Uganda or the interest is paid to a bank or a financial institution of a public character; and

- The interest is paid outside Uganda

Link the foregoing provisions to the case; we deduce the following

- That the income involved in the transaction is interest income earned in Uganda as is subject to tax (see fig1 above)

- Whereas Ham and DTB-U are taxed on their worldwide income; DTB-K is only taxed on income sourced from Uganda

- Ham’s interest payments to the lenders are allowable deductions for income tax purposes

- Interest income earned by DTB-K in such a syndicated transaction meets all the three conditions outlined under 83(5) and thus is exempt from with holding tax.

Value Added Tax (VAT):

Section 19 read together with the second schedule of the VAT Act as amended lists supply of financial services as an exempt supply for VAT purposes.

The Red Flags that provide opportunity for Illicit financial Flows under the Tax laws are:

- In case Ham’s registered corporations under Ham Enterprises and Kiggs Holdings are in non-profit making position; they pay no income tax; for instance, where interest payments to lenders is to an extent that it depletes the taxable income-Government stands to lose

- Under section 83(5) of the ITA, DTB-K pays zero tax to Ugandan Authorities, yet it has benefited from income sourced from Uganda.

- Under the second schedule of the VAT act, the syndicated transaction attracts no Value added tax-another loss for the Ugandan Government

Way forward

- The Government should reinforce efforts aimed at capitalising Uganda Development Bank (UDB) to ensure that domestic borrowers can obtain investment loans are lower interests before resorting to syndicated loans provides by pooled resources from commercial banks.

- Foreign financial institutions wishing to conduct financial institutions business in Uganda should adhere to the domestic legal framework to support ease of regulation by the Bank of Uganda and promote fiduciary transparency.

- The Financial Intelligence Authority of Uganda (FIA-U), and the Uganda Revenue Authority (URA) must work hand in hand to establish the income position and source of all borrowers involved in syndicated loans.

- The URA, must ensure that prior to satisfying the conditions under 83(5); due diligence is conducted to establish the ultimate beneficial owner under a syndicate loan arrangement.

[1] See: https://www.ceo.co.ug/pursued-by-3-banks-over-ugx-72-bn-in-debt-how-a-desperate-hamis-kiggundu-turned-to-courts-to-buy-more-time-but-in-the-process-cut-the-hands-that-fed-him/

[1] Robert Ssuuna is a Technical Lead Fair Tax Monitor at Tax Justice Network Africa

[2] Kasozi Mulindwa is Global Goals Champion