Tax Justice

is Our Main Goal

Building a new Africa where tax justice prevails and resources are sustainably harnessed for people to live in dignity.

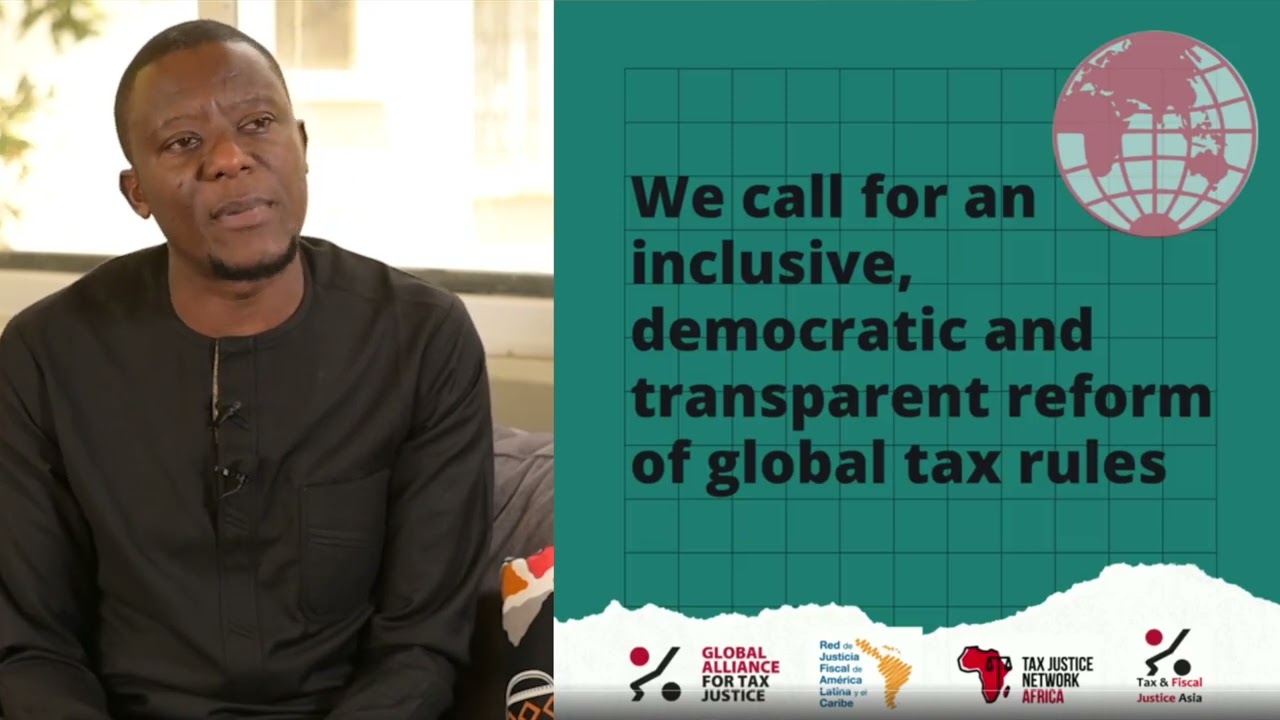

Tax Justice Network Africa (TJNA) is a robust network of civil society organisations founded in 2007 with the united effort of leading tax justice voices across the continent committed to promoting accountable and progressive taxation systems in Africa where tax justice prevails. Alongside leading researchers, policymakers, campaigners, and civil society organisations, we are mobilising a movement to comprehensively transform tax policies, challenge harmful investment practices, improve international tax transparency, and restore the sovereignty of natural resources to African countries. TJNA is the leading Pan-African civil society network dedicated to issues of Tax justice.

What We Do

Thematic areas

Tax Justice Network Africa is building a new Africa where tax justice prevails. Alongside leading researchers, policymakers, campaigners, and civil society organisations, we are mobilizing a movement to comprehensively transform tax policy, challenge harmful investment practices, improve international tax transparency, and restore sovereignty of natural resources back to African countries.

Join The Network

We believe that a just, prosperous, and integrated Africa is within reach. To join us in building a new Africa, where tax justice prevails and resources are sustainably harnessed for people to live in dignity

How we collaborate

Collaborating in our network

The network’s integrated approach and value proposition are inspired by its commitment to comprehensive tax justice solutions for adoption by African countries. As collaborators, TJNA members and partners work together in

Policy influencing

and collectively shaping the network’s work that addresses structural inequalities by offering thought leadership through the publication and dissemination of evidence-based research that defines and informs policy positions and engagements both at national and regional levels.

Awareness-raising

by informing critical stakeholders, including the media and the public through strategic communications and campaigns, the network collaboratively shapes regional and national discussions on progressive taxation on the continent, building a community of tax justice champions.

Capacity building

by enabling the network’s alliances and constituents to drive a progressive tax agenda, TJNA capacitates its advocates in their respective spheres of influence through its periodic training, conferences and workshops organised throughout the year including ITJA, PAC etc.

Mobilising

through strategic organising, the network leverages on its partnerships with network members and other key stakeholders to build momentum for integrated tax reforms by rallying together through coalitions and campaigns to scale up tax justice and cultivate a robust, powerful, and unified African voice such as the Stop the Bleeding Campaign.